Employers and private insurers paid hospitals, on average, 247% of what Medicare paid for the same services in 2018, per a new RAND study.

This study used data from 49 states and the District of Columbia. The sample includes data from 3,112 hospitals. Over the 2016 to 2018 period, the claims data used for this study accounted for $33.8 billion in spending by private payers. Of this amount, $15.7 billion consisted of spending for hospital inpatient claims, $14.8 billion in spending for hospital outpatient claims, and $3.3 billion in spending for professional claims provided in a hospital.

The analysis included approximately 750,000 claims for inpatient hospital stays and 40.2 million claims for outpatient services. The simulated Medicare payments for the same services provided by the same facilities totaled $14.1 billion—$6.9 billion for inpatient hospital claims, $5.2 billion for hospital outpatient claims, and $2.0 billion for associated professional services.

This difference implies that, overall, the private payers included in this study paid 240 percent of what Medicare would have spent at that time for the exact same services at the same set of facilities, a difference of $19.7 billion. Put another way, if the private health plans participating in the study had paid hospitals using Medicare’s payment formulas, the total

allowed amount over the 2016 to 2018 period would have been reduced by $19.7 billion, a potential savings of 58 percent.

Key Findings

- In 2018, across all hospital inpatient and outpatient services, employers and private insurers included in the report paid 247 percent of what Medicare would have paid for the same services at the same facilities. This difference increased from 224 percent of Medicare in 2016 and 230 percent in 2017.

- From 2016 to 2018, the overall relative price for hospitals (including inpatient and outpatient care) increased from 224 to 247 percent, a compounded annual rate of increase of 5.1 percent.

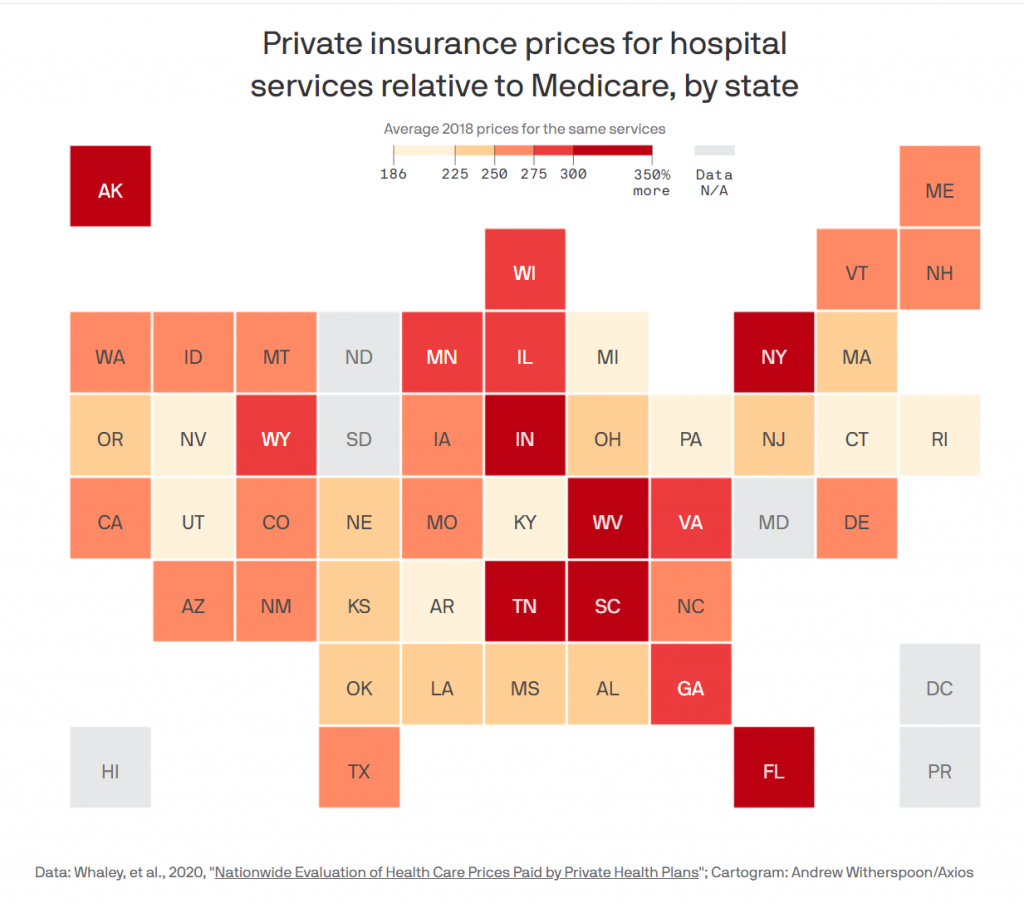

- Some states (Arkansas, Michigan, Rhode Island) had relative prices under 200 percent of Medicare; others (Florida, West Virginia, South Carolina) had relative prices that approached 350 percent of Medicare.

- High-value hospitals — those offering low prices and high safety — do exist. In at least some parts of the country, employers have options for high-value facilities that offer high quality at lower prices. However, there is no clear link between hospital price and quality or safety.

Employers are among the most important purchasers in the U.S. health care system. For many employers, health care benefits are the second largest business expense after wages.

However, many employers lack fundamental information about the health care prices that are negotiated on their behalf, which hamstrings their ability to be prudent purchasers of health care benefits. This report is designed to take a step toward reducing this information barrier for

employers, but information cannot by itself lead to changes in prices.

Although many hospitals do face increasing costs, such as growing employment and personnel costs, increased needs for investments in electronic health records, and other technologies, the results of this study show that some hospitals are still able to charge much lower prices than other hospitals. Moving patient volume to lower-priced hospitals that offer better value is an opportunity for employers, their employees, and society to reduce health care spending, and also helps the market to reward

the most efficient hospitals.

This process may require employers to think more judiciously about the prices that are being negotiated on their behalf, rather than outsourcing much of the work to brokers and TPAs. As illustrated in this report, there are large potential savings at stake.

source: https://www.rand.org/pubs/research_reports/RR4394.html